iamgenerator.site

Learn

Where To Put Savings For Down Payment

Most financial planners advise buyers to make a down payment of at least 20 percent to save on fees and private mortgage insurance. Minimum down payment requirements: · For homes that cost up to $,, the minimum down payment is 5% · For homes that cost more than $, and less than $1. Saving for a down payment is as simple as making small changes to your budget or exploring other financing options. Both could help you save more money. Getting a VA or USDA loan? You may be eligible for zero down payment options. Now, we're also not saying don't put 20% down. Conventional wisdom has. put away each month to meet your goal Down Payment Savings Calculator. Buying a home is likely the largest purchase you'll ever make. Use this. Receive gift money. · Take a loan from your (k) or other retirement plan. · Sell something. · Receive a windfall. · Give your savings a boost. Get advice, tips, and tricks to help you figure out how to save for a house and get the downpayment you need to own your dream home. Another great place to stash your cash? A traditional or Roth IRA, says Forrest. In addition to being a tax-friendly retirement vehicle, it allows you to. Learn how investing with BMO can help you reach the major milestone of home ownership faster. We'll show you the path to grow your savings for a down. Most financial planners advise buyers to make a down payment of at least 20 percent to save on fees and private mortgage insurance. Minimum down payment requirements: · For homes that cost up to $,, the minimum down payment is 5% · For homes that cost more than $, and less than $1. Saving for a down payment is as simple as making small changes to your budget or exploring other financing options. Both could help you save more money. Getting a VA or USDA loan? You may be eligible for zero down payment options. Now, we're also not saying don't put 20% down. Conventional wisdom has. put away each month to meet your goal Down Payment Savings Calculator. Buying a home is likely the largest purchase you'll ever make. Use this. Receive gift money. · Take a loan from your (k) or other retirement plan. · Sell something. · Receive a windfall. · Give your savings a boost. Get advice, tips, and tricks to help you figure out how to save for a house and get the downpayment you need to own your dream home. Another great place to stash your cash? A traditional or Roth IRA, says Forrest. In addition to being a tax-friendly retirement vehicle, it allows you to. Learn how investing with BMO can help you reach the major milestone of home ownership faster. We'll show you the path to grow your savings for a down.

Learn how investing with BMO can help you reach the major milestone of home ownership faster. We'll show you the path to grow your savings for a down. There are a bunch of different tax-advantaged accounts that you can use to squirrel that down payment money away a little faster. Put money into a savings or. Proper planning involves determining how big of a down payment you need and saving money for that down payment. Banks charge PMI to borrowers who put down. This calculator will help you create a savings plan towards your home purchase down payment. Simply use your purchase price to calculate how much you need to. Through the Home Buyers' Plan, you can borrow up to $60, from your RRSP to use as a down payment on your first home. If you can put down at least 20% on a conventional loan, you will qualify for the regular interest rate. If you can only save 10% of the purchase price, your. “If you struggle with savings, place a debit block on your savings account by speaking with a banker, then set up automatic deposit from your paycheck or. Decide what percentage of the home price you need to put away for a down payment and save consistently in a high-yield savings account. Your time frame for. Minimum down payment requirements: · For homes that cost up to $,, the minimum down payment is 5% · For homes that cost more than $, and less than $1. Use a CD ladder. When you save, you want to make every dollar count. Certificate of Deposit, or CD, laddering is a smart way to maximize compound interest. An offset mortgage allows money in savings accounts held at the same financial institution as the mortgage to offset the mortgage balance. A term payment plan. Coming up with the cash · Saving and investing · Family loans or gifts · Cashing out stock awards · Borrowing from your retirement savings · Explore home loans and. If a buyer put % down, they may be more committed to the home and less likely to default. If there is more equity in the property, the lender is more. down payments. 20% down. Finally, you may need to prepare to put down as much as 20% on your home purchase. This is the preferred amount among many mortgage. Another good habit is to match any discretionary spending with an equal deposit to your savings account. Looking at that $ TV? Only purchase it if you can. If you can reduce your housing costs by getting a roommate, moving back home or moving to a place with cheaper rent, add that extra cash to your automatic. Make an RRSP (Registered Retirement Savings Plan) part of your down payment saving strategy. It's true – putting aside a small amount every week in an RRSP can. TD High Interest Savings Account A place to put away the money you've saved · Tax-Free Savings Account There is a range of TFSAs that can help you save for short. You'll save exponentially if you can put a 20% down payment on a house. This is not only because you won't pay interest on the portion that you didn't have to.

Can You Take Money Out Of Fidelity 401k

Assuming your were in a normal k plan, withdrawing before retirement age means all the money will be taxed plus you will incur a 10% penalty. If you take money out of your k early, the IRS requires a minimum withholding of 20%. In addition, it levies a 10% early withdrawal penalty. If that. You may be eligible for a loan but taking withdrawals are usually only available if you've separated from the employer or you meet a hardship. When you take out a loan, you are simply borrowing money from your retirement plan account. You will repay the loan amount and interest to Fidelity on a monthly. Your k is safe in a bankruptcy, but if you take the money out it's at risk and will be taxed and penalized. Upvote Downvote Reply. It usually takes no more than days to receive your funds Whatever method you use, withdrawals from a brokerage account are rarely instant. When I tried. If you are under age 59½, your earnings may be subject to the 10% early withdrawal penalty. If you are over age 59½, you may withdraw before-tax funds . No. You can withdraw money from your (k) plan as and when the plan document allows. There is no time when it has to allow you to withdraw —. You can withdraw money via check from most non-retirement accounts. On Portfolio Summary, select Withdraw Money from the Select Action drop-down box. There are. Assuming your were in a normal k plan, withdrawing before retirement age means all the money will be taxed plus you will incur a 10% penalty. If you take money out of your k early, the IRS requires a minimum withholding of 20%. In addition, it levies a 10% early withdrawal penalty. If that. You may be eligible for a loan but taking withdrawals are usually only available if you've separated from the employer or you meet a hardship. When you take out a loan, you are simply borrowing money from your retirement plan account. You will repay the loan amount and interest to Fidelity on a monthly. Your k is safe in a bankruptcy, but if you take the money out it's at risk and will be taxed and penalized. Upvote Downvote Reply. It usually takes no more than days to receive your funds Whatever method you use, withdrawals from a brokerage account are rarely instant. When I tried. If you are under age 59½, your earnings may be subject to the 10% early withdrawal penalty. If you are over age 59½, you may withdraw before-tax funds . No. You can withdraw money from your (k) plan as and when the plan document allows. There is no time when it has to allow you to withdraw —. You can withdraw money via check from most non-retirement accounts. On Portfolio Summary, select Withdraw Money from the Select Action drop-down box. There are.

By age (and in some cases, age 55), you will be eligible to begin withdrawing money from your (k) without having to pay a penalty tax. Youll simply need. Withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty. Fidelity Brokerage. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. Go to iamgenerator.site or call Use this form to request a one-time withdrawal from a Fidelity Self-Employed (k), Profit Sharing, or Money Purchase. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. If you are over age 59½, you may withdraw before-tax funds (excluding your TVA matching funds) from the (k) Plan. You will not pay an early withdrawal. You contribute to your (k) account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of. To be eligible to withdraw funds from your (k) Fidelity account, you must typically be at least 59 ½ years old, retired, or have left your job. If you meet. Dipping into a (k) or (b) before age 59 ½ usually results in a 10% penalty. For example, taking out $20, will cost you $ Time is your money's. (k) withdrawal rules. The federal government imposes some restrictions on when you can withdraw money from your (k). Generally, you must wait until you're. For a withdrawal from your Employer-Sponsored Retirement Plan (such as a k or b) Single Withdrawal Request (You will be directed to NetBenefits. Once you. If you withdraw from your (k) before age 59½, the money will generally be subject to both ordinary income taxes and a potential 10% early withdrawal penalty. You can always withdraw your after-tax contributions penalty-free and tax-free. Taxable accounts, including mutual fund and brokerage accounts. If you have to. If you've made after-tax (non-Roth) contributions, your (k) plan can let you withdraw those dollars (and any investment earnings on them) for any reason, at. iamgenerator.site for additional information, which you can download for If you receive a payment from an IRA (including a Roth IRA; see section. Withdrawals can be initiated online for Traditional, Rollover, Roth and SEP IRAs using the "Withdraw from your IRA" button. For SIMPLE IRA distributions, please. Can employees take money out? Yes, employees can withdraw money, but keep in mind that a (k) is designed for long-term savings so. Perhaps the most common reason to take a distribution from your (k) is when you change jobs and move into the new job's retirement plan. But, if you're. Step 1: Understand Your Plan's Rules and Regulations · Step 2: Determine Your Eligibility for Cashing Out · Step 3: Calculate the Amount You Want to Withdraw. Key Takeaways · You may tap into (k) funds without penalty under certain circumstances. · Those who qualify for a hardship withdrawal can use the money for.

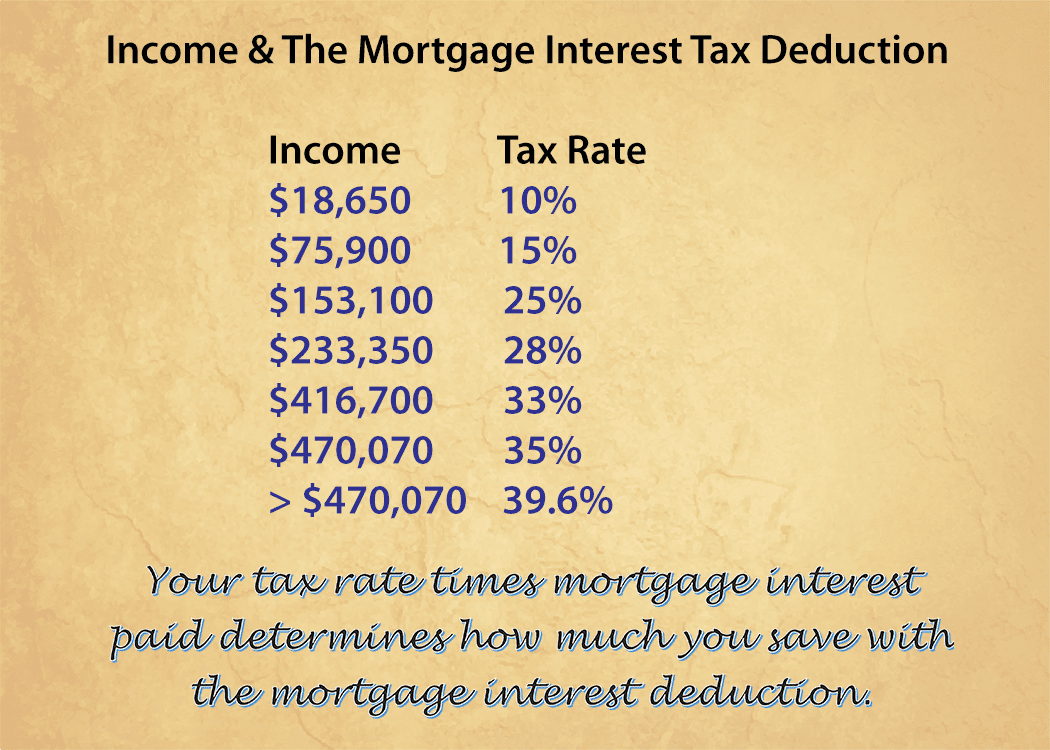

How Much Interest Can You Deduct From Taxes

Tax-deductible interest is a borrowing expense that the IRS allows taxpayers to claim on their federal or state tax returns, in order to reduce their taxable. Mortgage Deduction Requirements. Generally, your home mortgage interest is tax deductible up to $, For most taxpayers, this means your entire mortgage. The home mortgage interest deduction (HMID) allows homeowners to deduct mortgage interest paid on up to $, of their loan principal. · The maximum mortgage. How does the MID work? When filing annual federal income tax returns, the taxpayer(s) can deduct the interest paid in that tax year on a home mortgage. Taxpayers can deduct the interest paid on first and second mortgages up to $1,, in mortgage debt (the limit is $, if married and filing separately). The maximum amount of deduction allowed is based on how many dependents you If you were not allowed to deduct business interest on your federal income tax. The deduction is worth up to $1,, for interest paid on mortgages taken out prior to December 15, How much could you save with the mortgage interest. You may be able to deduct up to $2, of student loan interest from your taxes. You may be limited, or prevented from claiming the deduction entirely. Current IRS rules allow many homeowners to deduct up to the first $, of their home mortgage interest costs from their taxes. Homeowners who are married. Tax-deductible interest is a borrowing expense that the IRS allows taxpayers to claim on their federal or state tax returns, in order to reduce their taxable. Mortgage Deduction Requirements. Generally, your home mortgage interest is tax deductible up to $, For most taxpayers, this means your entire mortgage. The home mortgage interest deduction (HMID) allows homeowners to deduct mortgage interest paid on up to $, of their loan principal. · The maximum mortgage. How does the MID work? When filing annual federal income tax returns, the taxpayer(s) can deduct the interest paid in that tax year on a home mortgage. Taxpayers can deduct the interest paid on first and second mortgages up to $1,, in mortgage debt (the limit is $, if married and filing separately). The maximum amount of deduction allowed is based on how many dependents you If you were not allowed to deduct business interest on your federal income tax. The deduction is worth up to $1,, for interest paid on mortgages taken out prior to December 15, How much could you save with the mortgage interest. You may be able to deduct up to $2, of student loan interest from your taxes. You may be limited, or prevented from claiming the deduction entirely. Current IRS rules allow many homeowners to deduct up to the first $, of their home mortgage interest costs from their taxes. Homeowners who are married.

The sum of qualified home mortgage interest and real estate property taxes claimed under sections (h) and of the Code are allowed as an itemized. The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Use this calculator to see how much you. In most cases, you can deduct all of your home mortgage interest. How much you can deduct depends on the date of the mortgage, the amount of the mortgage, and. You can deduct home mortgage interest on the first $, ($, if married filing separately) of indebtedness. However, higher limitations ($1 million ($. What Interest Is Tax-Deductible? You can deduct several types of interest, including mortgage interest, student loan interest, investment interest, and business. What Interest Is Tax-Deductible? You can deduct several types of interest, including mortgage interest, student loan interest, investment interest, and business. Any interest paid on first, second or home equity mortgages over this amount is not tax-deductible. If you already have outstanding mortgages on other qualified. Taxpayers can deduct the interest paid on qualified residences for up to $, in total mortgage debt (the limit is $, if married and filing separately). The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes. The amount you can deduct is limited, but. The amount that you can deduct is capped at your net taxable investment income for the year. Any leftover interest expense gets carried forward to the next. 15, , you can deduct the interest on up to $, if you're filing jointly and up to $, if you're filing single. Mortgage Interest Deductions? Not a. By taking the mortgage interest deduction, your taxable income would fall to $65, Assuming your marginal tax rate is 25%, you could save $2, in taxes. In fact, federal student loan borrowers could qualify to deduct up to $2, of student loan interest per tax return per tax year. You can claim the student. The amount that you can deduct is capped at your net taxable investment income for the year. Any leftover interest expense gets carried forward to the next. You will then multiply what you pay in interest for the year by to get the total amount you can deduct that year. What Homeowner's Expenses Aren't Tax. Write off % = deduct % of the interest up to the limit of $k for individuals or $ if married filing separately. You don't get an. The interest paid on a mortgage, along with any points paid at closing, are tax-deductible if you itemize on your tax return. Taxpayers can deduct the. Can you deduct mortgage interest on a second home? If your second house was purchased before December 15, , is used primarily for personal use and isn't a. You can deduct home mortgage interest on the first $, ($, if married filing separately) of indebtedness. However, higher limitations ($, if. be one that is established by prevailing market rates for debts with similar terms and credit risks. How much can you deduct? In provinces and territories (with.

What Are Some Profitable Businesses

I created this big list of small business ideas for women (great for beginner entrepreneurs with side business ideas) for you who are stay at home moms. Best Solopreneur Business Ideas · Digital and Online Services · Creative and Artistic Services · Home and Personal Services · Consulting and Coaching · Retail. Some of the most profitable business ideas are website design, cleaning services and real estate. A profitable business is one that generates more revenue than it incurs in expenses. The profitability of a business is not merely about earning more income. the company to stay profitable. This could require patents, copyrights, trademarks, or preservation of trade secrets. Most businesses have names, logos. There are many great home business ideas you can start. From freelance services to dropshipping or even selling print-on-demand products, each has its own. 1. Cleaning services With no physical location needed and low equipment costs, opening a cleaning business can be quite profitable. Make sure your business adds real value for your customers because this is how you make money. The bottom line for making a profit isn't a number – it's the. Here are five of the most profitable businesses worth considering. Food Trucks For aspiring entrepreneurs, food trucks can be a good business idea. I created this big list of small business ideas for women (great for beginner entrepreneurs with side business ideas) for you who are stay at home moms. Best Solopreneur Business Ideas · Digital and Online Services · Creative and Artistic Services · Home and Personal Services · Consulting and Coaching · Retail. Some of the most profitable business ideas are website design, cleaning services and real estate. A profitable business is one that generates more revenue than it incurs in expenses. The profitability of a business is not merely about earning more income. the company to stay profitable. This could require patents, copyrights, trademarks, or preservation of trade secrets. Most businesses have names, logos. There are many great home business ideas you can start. From freelance services to dropshipping or even selling print-on-demand products, each has its own. 1. Cleaning services With no physical location needed and low equipment costs, opening a cleaning business can be quite profitable. Make sure your business adds real value for your customers because this is how you make money. The bottom line for making a profit isn't a number – it's the. Here are five of the most profitable businesses worth considering. Food Trucks For aspiring entrepreneurs, food trucks can be a good business idea.

In basic terms, your gross profit margin is how profitable your company is. It's the amount of money you have leftover after you've paid all your bills and. In this article, we will share 10 business ideas that are projected to be highly profitable in the coming years. Real estate investing is often considered one of the most profitable businesses for long-term growth. There are several reasons for this. 1. Get Organized · 2. Keep Detailed Records · 3. Analyze Your Competition · 4. Understand the Risks and Rewards · 5. Be Creative · 6. Stay Focused on Your Goals · 7. 1> Niche Subscription Services: Offering specialized subscription boxes or digital content tailored to specific interests or needs can be very profitable. The most profitable business in Canada is Primary Care Doctors. On average, this industry has a profit margin of %! 1. Real Estate Agency Real estate offers several lucrative careers. As a real estate agent, you can potentially earn great money. When you sell a house, you. Not sure which is the best business to dive into? We've got you covered. Here are eight of the most profitable business ideas. In this blog, we'll explore Australia's most profitable small businesses and explain how Thriday can help entrepreneurs achieve a profit. In this guide, I'm sharing the 12 most profitable online businesses you can start in These tried-and-true models are primed for success. We've compiled a list of the most profitable options with information on how to begin, startup costs, and earning potential. I created this big list of small business ideas for women (great for beginner entrepreneurs with side business ideas) for you who are stay at home moms. Podcasting can be a great business idea if you have a passion for media. The demand for audio content is growing, brands are always looking for new podcasts to. 1. Real Estate Agency Real estate offers several lucrative careers. As a real estate agent, you can potentially earn great money. When you sell a house, you. In this guide, I'm sharing the 12 most profitable online businesses you can start in These tried-and-true models are primed for success. When a business is profitable, that means that it generates more revenue (sales) than it spends (expenses). There are a few layers to this definition, so let's. What are the most profitable industries, and what are the most profitable companies within those industries? We've compiled a list of the most profitable options with information on how to begin, startup costs, and earning potential. Let's explore some of the most profitable online business ideas in Canada: Dropshipping, Affiliate Marketing, and Selling Digital Products.

How Much Does It Cost To Use Legalzoom

For example, LegalZoom charges $/year for registered agent service. Additionally, if you'd like to form a corporation instead of an LLC, LegalZoom charges at. The $20 fee is due every two years. For people who use intermediaries like create California LLC LegalZoom, the costs increase because you're going to pay for. After 30 days, your card will automatically be charged $ The service renews automatically each month and your card will be billed for the service price . How Much Does LegalZoom Cost? As there is a range of services that the site offers, pricing can range as well depending on what you choose. For example. The Starter package requires just the state's filing fees. The starting price of the Pro package is $ in addition to state filing fees, while the Premium. High prices – LegalZoom's registered agent service costs $ per year. While there are a couple of competing companies that charge more than that, there are. LegalZoom offers these online legal services at affordable prices. Packages are built to meet your specific needs and generally range from $79 to $, with. Registered agent service costs $ a year and comes with alerts when important mail is received, email reminders of important filing deadlines, unlimited cloud. LegalZoom provides access to independent attorneys and self-service tools. LegalZoom is not a law firm and does not provide legal advice, except where. For example, LegalZoom charges $/year for registered agent service. Additionally, if you'd like to form a corporation instead of an LLC, LegalZoom charges at. The $20 fee is due every two years. For people who use intermediaries like create California LLC LegalZoom, the costs increase because you're going to pay for. After 30 days, your card will automatically be charged $ The service renews automatically each month and your card will be billed for the service price . How Much Does LegalZoom Cost? As there is a range of services that the site offers, pricing can range as well depending on what you choose. For example. The Starter package requires just the state's filing fees. The starting price of the Pro package is $ in addition to state filing fees, while the Premium. High prices – LegalZoom's registered agent service costs $ per year. While there are a couple of competing companies that charge more than that, there are. LegalZoom offers these online legal services at affordable prices. Packages are built to meet your specific needs and generally range from $79 to $, with. Registered agent service costs $ a year and comes with alerts when important mail is received, email reminders of important filing deadlines, unlimited cloud. LegalZoom provides access to independent attorneys and self-service tools. LegalZoom is not a law firm and does not provide legal advice, except where.

LegalZoom does not charge fees until documents are submitted to the state. Thereafter, users can expect to pay $ for the first year and it will renew. How much does LegalZoom cost? · Business formation – from $79 + state fees · Legal consultation – from $ per month · Personal services · Ongoing costs · State. There are also many different things that Legal Zoom is going to try and upsell you on. You may think that you have to use what they are offering if you are not. LegalZoom is the least cost-effective legal service out there. Customers of iamgenerator.site are essentially paying hundreds or thousands of dollars to do all of. Incorporate a nonprofit at an affordable cost through LegalZoom. Choose from three packages to fit your specific business needs. See our pricing options. It costs $79 plus state filing fees to form an LLC with a Basic LLC package. Even though it is not the cheapest and fastest service available, you can take. Legal zoom is absolutely a ripoff, depending on your state you can use yourself as an LLC rep in your articles of incorporation. LLC LegalZoom Cost: How Much Does It Cost To Form An LLC? The state filing fee is the main expense involved in forming an LLC and can range anywhere from $ LegalZoom®. Standard Legal ; LEGAL TOPIC: Pricing Options+, Legal Forms Software ; Last Will and Testament, $69 - $79, $ The mid-tier package costs $ while the topmost tier costs $ It helps to note that state fees do not apply to any of these packages as these are paid. LegalZoom's costs are minimum somewhere around $99 bucks The part that is costly is the State filing fee. This depends on what state the. Find out how much it costs to file a DBA through LegalZoom. LegalZoom's DBA registration packages offer exceptional value and come with lifetime customer. For example, LegalZoom charges $/year for registered agent service. Additionally, if you'd like to form a corporation instead of an LLC, LegalZoom charges at. After 30 days, your card will automatically be charged $ The service renews automatically each month and your card will be billed for the service price . For example, a last will and testament package may cost around $89, while a living trust package can range from $ to $ Additional services such as power. The Economy package costs $79 plus the state filing fee. It comes with basic features and can take up to 30 business days. 1. Comprehensive Name Search and. The fee you see from LegalZoom consists of the government TEAS Standard electronic filing fee of $ If the stricter "TEAS Plus" system can be used for your. LegalZoom Pricing · Business registration: $79 to $ depending on the state and package · Legal documents: $59 per document or $ per month for unlimited. LegalZoom offers three packages for their Last Will product. The Basic package has a cost of $69 and includes a personalized will and a digital download of the. Its monthly package fees start at $ for individuals and $ for business owners. These prices are almost half the price of some competitors, and hundreds.

Buy Destiny

During her travels, she finds a gift to honor your service—a Light to accompany the Darkness. BUY NOW. One way to narrow down your choices is to consult a Destiny 2 exotic weapons tier list, which ranks the exotics in terms of potency and practicality. Buy Destiny 2 · Bungie Store · Bungie Rewards · Rewards. expand_more · Bungie Store Download the Destiny Companion App. Download on the AppStoreGet it on. Why Buy a Destiny Account from a seller? A more practical reason buyers may choose to purchase a Destiny 2 account for sale would be the fact that sellers. Destiny 2 Armor sets & ornaments farm services for sale. Get best new hunter, titan or warlock armor sets fast. Order & we'll start your boosting now! We created this category where you will find the most desired exotics and other Destiny 2 stuff for sale that includes but is not limited to resource farming. Destiny - The Collection contains every release from the award-winning first-person shooter franchise to date. Destiny 2 is an action MMO with a single evolving world that you and your friends can join anytime, anywhere, absolutely free. Shop for destiny 2 at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. During her travels, she finds a gift to honor your service—a Light to accompany the Darkness. BUY NOW. One way to narrow down your choices is to consult a Destiny 2 exotic weapons tier list, which ranks the exotics in terms of potency and practicality. Buy Destiny 2 · Bungie Store · Bungie Rewards · Rewards. expand_more · Bungie Store Download the Destiny Companion App. Download on the AppStoreGet it on. Why Buy a Destiny Account from a seller? A more practical reason buyers may choose to purchase a Destiny 2 account for sale would be the fact that sellers. Destiny 2 Armor sets & ornaments farm services for sale. Get best new hunter, titan or warlock armor sets fast. Order & we'll start your boosting now! We created this category where you will find the most desired exotics and other Destiny 2 stuff for sale that includes but is not limited to resource farming. Destiny - The Collection contains every release from the award-winning first-person shooter franchise to date. Destiny 2 is an action MMO with a single evolving world that you and your friends can join anytime, anywhere, absolutely free. Shop for destiny 2 at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up.

BuyBuy now. Rise Guardian, the future of humanity rests upon your shoulders And dare we say, we have the best Destiny 2 price! About Eneba; About us. The Bungie Store is the official store for Bungie, Inc., the developer of Destiny, Halo, Myth, Oni, and Marathon. Where to buy weapons in Destiny 2? You can buy weapons Destiny 2 from different vendors in-game including Banshee, Lord Shaxx or Lord Saladin, or otherwise. See DXYZ ETF price and Buy/Sell Destiny Tech Inc. Discuss news and analysts' price predictions with the investor community. Find the best Destiny 2 DLCs on Driffle. Enhance your gameplay with new content at the cheapest prices. Enjoy instant delivery and top deals. Best Destiny 2 silver store - iamgenerator.site offers Destiny 2 Destiny2 Silver for all gamers. You can buy Destiny 2 Silver forDestiny2 with the lowest price. Buy Destiny 2: The Final Shape on PlayStation Store. Available 5 June, , confront oblivion and face the Witness. Any PvE & PvP Destiny 2 boost available to buy on PC, XBOX, and PS4. Your consumer rights are our priority. + Reviews on Trustpilot. 24/7 support. Any PvE & PvP Destiny 2 boost available to buy on PC, XBOX, and PS4. Your consumer rights are our priority. + Reviews on Trustpilot. 24/7 support. There's a "Destiny 2: Legacy Collection ()" bundle that contains Shadowkeep, Beyond Light, and The Witch Queen for $ (was $); I. Enjoy the vast offer of the Destiny 2 DLCs and expansions at the most attractive prices on the market. Don't overpay – buy cheap on iamgenerator.site! You can only buy weapon farming service as a piloted type of service, with account sharing, meaning one of our boosters is going to log into your account and. There's no need to farm when you join our million users and find cheap Destiny 2 items for sale on PlayerAuctions! Safe and fast delivery with. Compare Prices from 13 stores to find the Best Deals for Destiny 2 Steam cd key. Buy the game cheaper with iamgenerator.site! If you are purchasing after September , please visit iamgenerator.site for current storage requirements prior to purchase. Additional. Looking to buy Destiny 2 accounts? Discover the best sites for Destiny 2 accounts for sale. Find trusted providers and top services to enhance your gaming. BuyBuy now. Rise Guardian, the future of humanity rests upon your shoulders And dare we say, we have the best Destiny 2 price! About Eneba; About us. Buy Destiny 2: The Final Shape cheaper on Instant Gaming, the place to buy your games at the best price with immediate delivery! Get your keys for Destiny 2 and save money thanks to iamgenerator.site

401k Social Security Tax

Traditionally, (k) distributions are taxed as ordinary income. However, the tax burden you'll incur varies by the type of account you have—a traditional Social Security and Railroad Retirement benefits are not taxable under the New Jersey Income Tax and should not be reported as income on your State return. Page. It depends on the type of contribution. Generally, these withholding rules apply. See Publication A, Employer's Supplemental Tax Guide PDF, for details. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. Social Security and. Income Tax Topics: Social Security,. Pensions, and Annuities. 1. Revised February Individuals may be allowed to claim a subtraction on their Colorado. If your retirement income includes Social Security benefits, distributions from a (k) or IRA, or a pension, you won't see a tax bill from the states on this. In , the Social Security tax was %, with the employer and the employee each paying half ( percent). Self-employed individuals pay both sides of the. In fact, income taxes might be your single largest expense in retirement. Taxation of Social Security Benefits. Many older Americans are surprised to learn they. Regardless of your income level, no more than 85% of your Social Security benefits will ever be subject to federal taxation. Traditionally, (k) distributions are taxed as ordinary income. However, the tax burden you'll incur varies by the type of account you have—a traditional Social Security and Railroad Retirement benefits are not taxable under the New Jersey Income Tax and should not be reported as income on your State return. Page. It depends on the type of contribution. Generally, these withholding rules apply. See Publication A, Employer's Supplemental Tax Guide PDF, for details. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. Social Security and. Income Tax Topics: Social Security,. Pensions, and Annuities. 1. Revised February Individuals may be allowed to claim a subtraction on their Colorado. If your retirement income includes Social Security benefits, distributions from a (k) or IRA, or a pension, you won't see a tax bill from the states on this. In , the Social Security tax was %, with the employer and the employee each paying half ( percent). Self-employed individuals pay both sides of the. In fact, income taxes might be your single largest expense in retirement. Taxation of Social Security Benefits. Many older Americans are surprised to learn they. Regardless of your income level, no more than 85% of your Social Security benefits will ever be subject to federal taxation.

qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. This equals % in FICA taxes per paycheck (until the Social Security wage base is reached), which you are legally obligated to match. Some employees may also. Retirement and pension benefits include most income that is reported on Form R for federal tax purposes. This includes defined benefit pensions, IRA. But by then, you might have a smaller retirement income and be in a lower tax bracket. So, when you do finally pay taxes, there's a chance that the tax bill. However, a (k) withdrawal can affect your adjusted gross income (AGI) and therefore how much of your Social Security is taxed. (K) plans) reported on federal Form or SR, Line 5b. Federation of Tax Administrators · Internal Revenue Service (IRS) · Additional. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that. Only earned income, your wages, or net income from self-employment is covered by Social Security. Social Security Wages are wages that are subject only to Social Security taxes. For example, a k plan is not subject to federal and state withholdings. In fact, income taxes might be your single largest expense in retirement. Taxation of Social Security Benefits. Many older Americans are surprised to learn they. Most states don't tax Social Security benefits, and there are a few states that tax (k) plans and IRA distributions but not pensions. Of course, there are a. If your retirement income includes Social Security benefits, distributions from a (k) or IRA, or a pension, you won't see a tax bill from the states on this. (k), (b), and similar investments; Tier 2 Railroad Retirement Virginia does not tax Social Security benefits. If any portion of your. However, traditional (k) contributions are still considered taxable for social security tax purposes (%), Medicare tax purposes (%). Eligibility is always based on work. Most jobs take Social Security taxes out of your paycheck so you can get a monthly benefit in retirement. Check your. insurance, life insurance, disability insurance, and (k) contributions. That is because there is a maximum amount of wages Social Security can tax high-. How Social Security tax is calculated · If your combined income is under $25, (single) or $32, (joint filing), there is no tax on your Social Security. Social Security benefit taxes are based on what the Social Security Administration (SSA) refers to as your “combined” income. That consists of your adjusted. The Social Security portion of FICA is % of the maximum taxable wages. · If you reach the maximum payment, you do not pay any more Social Security tax until.

Best Auto Loan Interest Rates 2021

The rate you get is going to vary from bank to bank and credit union to credit union. Some may give their “best” rate to anybody above Auto Loans. Lock in your next ride with rates as low as % APR!1. Apply Now Call Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. New - · - , up to 65, %, % ; Used - · - , up to 65, %, % ; Used - · - , up to 60, %. Auto loan interest rates for all credit scores for new car loans (at month terms) have gone from a high of % in to a low of % in , and as. Shop around the dealer websites for specials. Toyota has rates as low as 4%, but my credit union is sitting at %. When buying your car focus. In fact, auto refinance loans are some of the cheapest loans that LightStream offers, with APRs as low as %. Borrowers take out the loan from LightStream. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit. The rate you get is going to vary from bank to bank and credit union to credit union. Some may give their “best” rate to anybody above Auto Loans. Lock in your next ride with rates as low as % APR!1. Apply Now Call Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. New - · - , up to 65, %, % ; Used - · - , up to 65, %, % ; Used - · - , up to 60, %. Auto loan interest rates for all credit scores for new car loans (at month terms) have gone from a high of % in to a low of % in , and as. Shop around the dealer websites for specials. Toyota has rates as low as 4%, but my credit union is sitting at %. When buying your car focus. In fact, auto refinance loans are some of the cheapest loans that LightStream offers, with APRs as low as %. Borrowers take out the loan from LightStream. * Rates “as low as” % APR assumes excellent creditworthiness; your rate may differ from the rate(s) shown here. Rate and loan amount subject to credit.

Regular Auto Loan Rates ; , up to 36 mos, $5,, % ; mos, $8,, %. What Is the Average Interest Rate on a Car Loan by Lender? · Alliant – % · CapitalOne – %% · PenFed – % % · PNC Bank – %%. Auto Loans ; & Newer Vehicles. rates as low as. % ; & Older Vehicles. rates as low as. % ; Boats, Campers & RVs. Rates as low as. %. For a three-year car loan, % is the average auto loan interest rate. Keep in mind that your credit score as well as where you're getting the loan can affect. Average Auto Loan Rates for Excellent Credit · or higher, % ; Average Auto Loan Rates for Good Credit · , % ; Average Auto Loan Rates for Fair. What Is the Average Interest Rate on a Car Loan by Lender? · Alliant – % · CapitalOne – %% · PenFed – % % · PNC Bank – %%. Auto Loan Rates ; %. %. %. % ; %. %. %. %. Loan Rates ; 36 months or less 37 - 48 months 49 - 60 months ; %* %* %*. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. On average, used car loan interest rates in range from 5% to 18% depending on your credit score. If your credit score is higher, your auto loan rate would. Average interest rates for car loans The average APR on a new-car loan with a month term was % in the first quarter of , according to the Federal. Average Rates for Auto Loans by Lender · Alliant: - percent · CapitalOne: - percent · PenFed: - 18 percent · PNC Bank: - CONVENTIONAL AUTO LOAN MODEL YEARS: & NEWER ; 3 Year (36 Month), %, $ ; 5 Year (60 Month), %, $ ; 6 Year (72 month)**, %, $ For those who don't qualify for 0% APR offers, “good” interest rates typically range anywhere from 2% to 7%, depending on how low the benchmark rate established. & Newer Vehicle Rates ; 24 Month · % · $ per $1, ; 36 Month · % · $ per $1, ; 48 Month · % · $ per $1, ; 63 Month · % · $ Regular Auto Loan Rates ; , up to 36 mos, $5,, % ; mos, $8,, %. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. A lower interest rate is offered when borrowing at the "Trade" value or less. Best Rates: Veridian Credit Union America's Best Regional Banks and Credit. How Do You Get the Best Car Finance Rate? As you can see from the above numbers, the best rates for an auto loan can vary significantly, depending on your.

Reviews For Fidelity Investments

Old review: “Fidelity has always felt customer-oriented and professional. Unfortunately, this apps User Interface (UI) fails to live up to that standard. Fidelity cons: · The fee structure for the portfolio advisory services and wealth management are comparable to those of traditional investment managers. · The. Fidelity remains our top overall choice for best online broker as well as our choice as the best broker for low costs and for ETFs this year. Fidelity Investments is rated out of 5, based on reviews by employees on AmbitionBox. Fidelity Investments is known for Job Security which is rated at. Fidelity Alternative Investments Program · Tax Forms & Information · Retirement Review your investment strategy. Revisit your overall investment mix in. Old review: “Fidelity has always felt customer-oriented and professional. Unfortunately, this apps User Interface (UI) fails to live up to that standard. Fidelity's managed accounts are somewhat overpriced. The Fidelity Go robo advisor charges % for a balance of $25, or more, which is higher than most. “Fidelity Investments is a big scam!” Mariah C. Fidelity Investments is a sham operation. They choose to close any account they deem not worth their time. 24 reviews of FIDELITY INVESTMENTS "A clean and well-staffed investment center, located on the first floor of the building. Park with the valet and be sure. Old review: “Fidelity has always felt customer-oriented and professional. Unfortunately, this apps User Interface (UI) fails to live up to that standard. Fidelity cons: · The fee structure for the portfolio advisory services and wealth management are comparable to those of traditional investment managers. · The. Fidelity remains our top overall choice for best online broker as well as our choice as the best broker for low costs and for ETFs this year. Fidelity Investments is rated out of 5, based on reviews by employees on AmbitionBox. Fidelity Investments is known for Job Security which is rated at. Fidelity Alternative Investments Program · Tax Forms & Information · Retirement Review your investment strategy. Revisit your overall investment mix in. Old review: “Fidelity has always felt customer-oriented and professional. Unfortunately, this apps User Interface (UI) fails to live up to that standard. Fidelity's managed accounts are somewhat overpriced. The Fidelity Go robo advisor charges % for a balance of $25, or more, which is higher than most. “Fidelity Investments is a big scam!” Mariah C. Fidelity Investments is a sham operation. They choose to close any account they deem not worth their time. 24 reviews of FIDELITY INVESTMENTS "A clean and well-staffed investment center, located on the first floor of the building. Park with the valet and be sure.

Fidelity is one of the largest brokers in the world. They offer $0 trading commissions, over mutual funds with no transaction fees and high quality. Invest at a firm invested in you. Fidelity's secure and easy-to-use award-winning app gives you access to a broad choice of investments, expert insights. %, yes. Fidelity has been in business for over 70 years and has a successful track record. It is suitable for investors with all levels of experience. It is. Learn what working and interviewing at Fidelity Investments is really like. Read real reviews, ask and answer questions. I've been with Fidelity for 13 to 14 years. They are the best broker I have had. Their representatives have been intelligent and efficient and well trained. I. Fidelity Institutional helps advisors, financial professionals, and wealth management firms add value & efficiency through client expertise. 24 reviews of FIDELITY INVESTMENTS "A clean and well-staffed investment center, located on the first floor of the building. Park with the valet and be sure. Fidelity's Independent Review Committee publishes annual reports to investors. Read the reports. How to invest with Fidelity. There are two ways to buy. Anonymous Fidelity Investments reviews and ratings from employees. See what women say about what it's like to work at Fidelity Investments. Fidelity Investments has an overall rating of out of 5, based on over 17, reviews left anonymously by employees. 84% of employees would recommend working. From through , NerdWallet3 has rated Fidelity the Best App for Investing and the Best Online Broker for Beginning Investors. iamgenerator.site4 also. Fidelity Investments. likes · talking about this. Please More tips linked in the comments. Clara Wallace and 20 others. Ratings for Fidelity Investments ; Appreciation. ; Company Outlook. ; Fair Pay. ; Learning and Development. ; Manager Communication. Employees rate Fidelity Investments out of 5 stars based on 15, anonymous reviews on Glassdoor. In. Fidelity is a good choice for beginner investors and those who might need extra customer support because they've adopted an investor-friendly attitude. Fidelity Investments. likes · talking about this. Please More tips linked in the comments. Clara Wallace and 20 others. Our Markets and Insights hub is a great place to stay on top of market news, investing ideas and investing principles. You can also reach out to us on social. Fidelity Investments is an all-around winner for offering almost anything an investor would need. The brokerage especially appeals to us for its abundant. How much would you pay to invest with Fidelity? We've estimated the cost of investing over the course of a year in a Fidelity stocks and shares Isa, assuming.

Example Of Bad Credit Score

Credit scores From VantageScore · In terms of bad credit, VantageScore breaks down poor credit into two different categories depending on severity: · For example. bad credit scores. Description, Credit Score 1, Mortgage Rate 2, Example Lender. Major Banks - Prime Lenders, Financial institutions including the big banks. What is a bad credit score? · Very poor: to · Fair: to · Good: to · Very good: to · Excellent: to A low credit score means you have bad credit. Different companies have But is it worth paying money for? For Example. Playing in picture-in-picture. Credit scores From VantageScore · In terms of bad credit, VantageScore breaks down poor credit into two different categories depending on severity: · For example. On its scale of to , FICO® considers a score below to signify poor credit. A credit score is a tool lenders use to help gauge how much risk. A "bad” credit score is often considered anything that falls below on the Fair Isaac Corporation (FICO) scoring model. FICO scores are the credit scores. A score of or above on the same range is considered to be excellent. Most consumers have credit scores that fall between and In , the average. FICO® Scores in the Very Poor range often reflect a history of credit missteps or errors, such as multiple missed or late payments, defaulted or foreclosed. Credit scores From VantageScore · In terms of bad credit, VantageScore breaks down poor credit into two different categories depending on severity: · For example. bad credit scores. Description, Credit Score 1, Mortgage Rate 2, Example Lender. Major Banks - Prime Lenders, Financial institutions including the big banks. What is a bad credit score? · Very poor: to · Fair: to · Good: to · Very good: to · Excellent: to A low credit score means you have bad credit. Different companies have But is it worth paying money for? For Example. Playing in picture-in-picture. Credit scores From VantageScore · In terms of bad credit, VantageScore breaks down poor credit into two different categories depending on severity: · For example. On its scale of to , FICO® considers a score below to signify poor credit. A credit score is a tool lenders use to help gauge how much risk. A "bad” credit score is often considered anything that falls below on the Fair Isaac Corporation (FICO) scoring model. FICO scores are the credit scores. A score of or above on the same range is considered to be excellent. Most consumers have credit scores that fall between and In , the average. FICO® Scores in the Very Poor range often reflect a history of credit missteps or errors, such as multiple missed or late payments, defaulted or foreclosed.

When it comes to your Experian Credit Score, – is classed as Poor and 0– is considered Very Poor. Though remember, your credit score isn't fixed. If. Conversely, bad credit is seen as typically falling below This is credit that is well below the average score for US consumers and shows that you're a. Your credit score is calculated based on what's in your credit report. For example: Depending on the credit reporting agency, your score will be between zero. Good financial choices help lenders and businesses see you as low-risk. You'll be more likely to receive financial opportunities, including higher credit limits. For the example below, factors like recent missed payments, delinquencies, bad payment history and high credit usage are all contributing to a bad credit score. The common causes of bad credit include late payment of bills, bankruptcy filing, Charge-offs, and defaulting on loans. Bad Credit Explained. Any person who has. For example, if you borrowed $20, to buy a car and have paid back $5, of it on time, even though you still owe a considerable amount on the original loan. You get a bad credit score by not making payments on credit card bills, phone bills, any bills really. Being sent to collections, defaulting on. When it comes to the actual number, anything less than a FICO® Score is considered “subprime,” according to Experian™, one of the three main credit bureaus. to Poor Credit Score Individuals in this range often have example: income, how long you have lived at your residence, and other banking. Most credit scores range from But at what point does a lender consider a credit score to be low? How bad is a credit score, for example? Would. What are the credit score ranges? · A score of or higher is generally considered excellent credit. · A score of to is considered good credit. · Scores. For example, you might choose to find out your credit score from ClearScore. Your ClearScore rating is the same as your Equifax rating because that's where they. A common example of creating bad debt is using a credit card to purchase clothes. Clothes are typically worth less than 50% of what you pay for them when. The two primary credit scoring models are FICO® credit scores and VantageScores®. Both consumer credit score models have a credit score range of But. A credit score is a numerical rating from to that expresses how much of a potential risk you may be to lenders. Simply put: A low number means you are a. A low score means you have “bad” credit, which means it will be harder For example, under some scoring systems loans to consolidate your debt — but. But if you have a bad credit score — somewhere in the FICO range of to or VantageScore range of to — you'll miss out on these deals and often. Conversely, the better your score, the better the rates you'll qualify for with mortgages, auto loans, credit cards, and other types of loans. Who Decides What. or less: Bad Credit or High Risk. to Fair Credit or Fair Risk. +: Good Credit or Low Risk. The FICO score takes into account data.